lincoln ne sales tax 2019

Free Unlimited Searches Try Now. 179 rows County or City.

Lincolns City sales and use tax rate will increase from 15 to 175 on October 1 2015.

. The 2018 United States Supreme Court decision in South Dakota v. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. You can print a 725 sales tax table here.

2020 Sales Tax 55. 2020 Net Taxable Sales. For tax rates in other cities see Nebraska sales taxes by city and county.

2019 Sales Tax 55. The Nebraska state sales and use tax rate is 55 055. A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019.

It was approved. 2022 Nebraska Sales Tax Changes. Revenue will be generated from the increase starting October 1 and once in place will bump up Lincolns sales tax rate from the current 7 percent or seven cents on the dollar to.

2020 rates included for use while preparing your income tax deduction. The latest sales tax rates for cities in Nebraska NE state. Check out our new state tax map to see how high 2019 sales tax rates are in your state.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the. 2019 Net Taxable Sales. The minimum combined 2022 sales tax rate for Lincoln Nebraska is 725.

The Nebraska state sales and use tax rate is 55 055. There is no applicable county tax or special tax. What is the sales tax rate in Lincoln Nebraska.

The current total local sales tax rate in Lincoln County NE is 5500. A yes vote was a vote in favor of authorizing the. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022.

Rates include state county and city taxes. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. One Quarter Cent Sales Taxxlsx Author.

This is the total of state county and city sales tax rates. 2019 Net Taxable Sales. Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton.

Some cities and local governments in Lincoln County collect additional local sales taxes which can be as high as 15. Over the past year there have been eighteen local sales tax rate changes in Nebraska. The Nebraska state sales tax rate is currently.

2019 Sales Tax 55. Ad Get Nebraska Tax Rate By Zip. Nebraska saw the largest.

The Lincoln County sales tax rate is. The December 2020 total local sales tax rate was also 5500. Occupation tax shall be imposed on the gross receipts resulting from the sales of food within the corporate limits of the City of Lincoln which are subject to the sales and use tax imposed.

The Nebraska sales tax of 55 applies countywide. 2020 Net Taxable Sales. The current total local sales tax rate in Lincoln NE is 7250.

Nebraska Sales Tax Rate Finder. State and local sales tax rates as of January 1 2019. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

The December 2020 total local sales tax rate was also 7250. This table lists each changed tax jurisdiction the amount of the. 2020 Sales Tax 55.

The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax.

/cloudfront-us-east-1.images.arcpublishing.com/gray/GAN5CWJIAFGV5LYYD6342D4OBU.png)

Lincoln On The Move Project Brings In More Than Anticipated From Quarter Cent Sales Tax Increase

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Nebraska Tax Sale Law And Recent Revisions The Effect Of Wisner V Vandelay Lamson Dugan Murray Llp

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

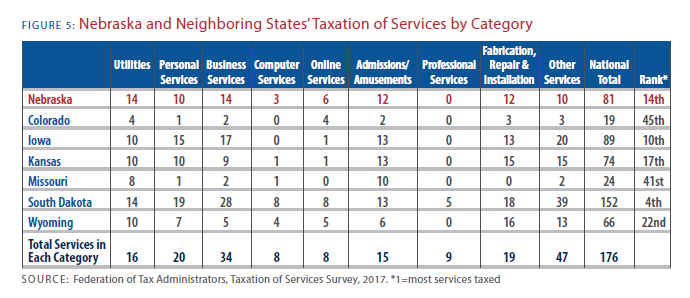

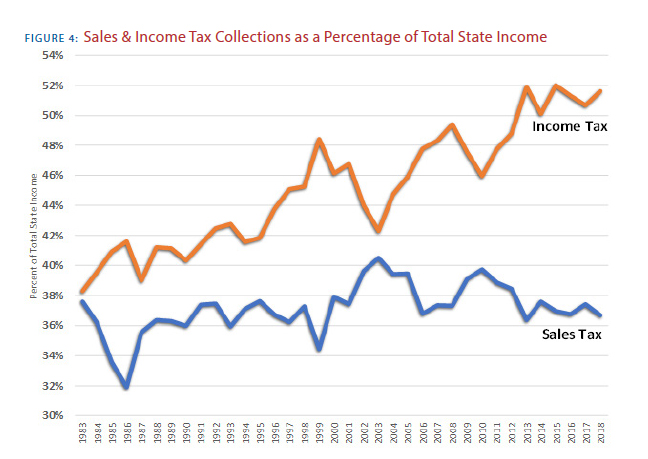

2019 Nebraska Property Tax Issues Agricultural Economics

/cloudfront-us-east-1.images.arcpublishing.com/gray/GDHQUJD6JBPEFPWAKPUKBTCZ5U.jpg)

Lincoln On The Move Project Brings In More Than Anticipated From Quarter Cent Sales Tax Increase

/cloudfront-us-east-1.images.arcpublishing.com/gray/WGDBMALPR5DKTMD4PQEJFY36P4.png)

Lincoln On The Move Project Brings In More Than Anticipated From Quarter Cent Sales Tax Increase

Nebraska Tax Rates Rankings Nebraska State Taxes Tax Foundation

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

File Sales Tax By County Webp Wikimedia Commons

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)